Section 179 at a Glance for 2025

Below is an overall, "birds-eye" view of the Section 179 Deduction for 2025. Contact us for more details on limits and qualifying equipment.

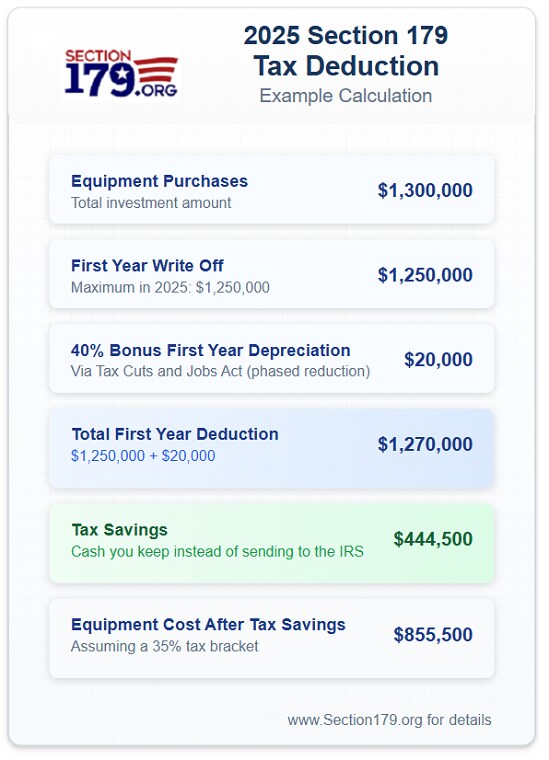

Here is an updated example of Section 179 at work during the 2025 tax year.

Section 179 Tax Deduction

There's a provision in the US tax code called Section 179 that allows you to deduct anywhere from 50% to 100% of the amount of your purchase price on a qualified vehicle that you use for business purposes. Just consider the amount you might spend on a Ford heavy-duty truck or a Ford Transit cargo van as an example. You may be able to deduct a portion of the cost of that Ford vehicle when you do your taxes the following year.

So if you bought an eligible Ford vehicle at Watseka Ford Lincoln Inc. in Watseka, IL and used it entirely for business purposes in 2025, you may be able to deduct 100% of the purchase price when you do your taxes in 2026.

You can now get the full business tax deduction in a single year

You might be able to deduct the purchase price of a new or a "new to you" Ford vehicle when you utilize it for business use as an immediate expense deduction. Business owners from Fowler, IN are allowed to deduct that van or truck expense based on the amount of the vehicle's business use. You can take up to a 100% tax deduction instead of having to depreciate the asset with smaller deductions over a period of time.

To comply with Section 179 guidelines, an eligible Ford vehicle you buy from our new inventory must be used for business purposes more than 50% the time in order for the deduction to be allowable. All a business owner in Gilman, IL has to do is multiply the price of the vehicle by the percentage of its business use to determine the allowable amount of the tax deduction. So if you used a Ford 2500 Super Duty truck for business 75% of the time, you would be allowed to deduct 75% of the purchase price when you do your taxes next year.

What expenses are qualified for a Section 179 deduction?

Section 179 is applicable only for business income, not personal. So if you bought a Ford vehicle that you use only for personal applications, it won't be eligible. Limits for the 2025 tax year a up to $1,250,000 in qualifying purchases.

As long as you follow IRS guidelines, you can take the cost of a new or "new to you" Ford vehicle that you put into use as an immediate expense deduction. That allows a St. Anne, IL business owner to deduct the expense based on the amount of business use for that vehicle. You can take as much as a full 100% tax deduction in a single year.

What kinds of vehicles are eligible for a Section 179 tax deduction?

In general, Section 179 deductions in 2025 are available only for vehicles that weigh more than 6,000 pounds. That includes heavy SUVs, pickups and vans that weigh more than 6,000 pounds. Also eligible for Milford, IL businesses are non-personal work vehicles like a heavy-duty Ford truck or a delivery vehicle like a Ford Transit cargo van.

Based on vehicle weight, some Ford vehicles that would be eligible for a Section 179 deduction include the Ford Expedition weighing 7,450 pounds, the Ford F-250 Super Duty truck weighing about 10,000 pounds and the Ford F-350 Super Duty truck, weighing in at 14,000 pounds. Also eligible based on vehicle weight are Ford Transit Cargo T-250 HD vans weighing around 9,070 lbs and Ford Transit Passenger Wagons that weight about 10,350 pounds.

Consult with your tax advisor to confirm these guidelines

Section 179 business expense tax deductions are available for many small businesses when you purchase an eligible vehicle. The guidelines listed above are based on our understanding of this tax provision but we encourage you to talk with your tax consultant to get a professional judgment on the proper ground rules.

We have a wide variety of Ford models that are eligible for Section 179 business deductions. Just follow the directions to our dealershipand we'll be glad to help you buy a qualified Ford model at Watseka Ford Lincoln Inc. in Watseka, IL.

How can we help?

* Indicates a required field

-

Watseka Ford Lincoln Inc.

101 Bell Road

Watseka, IL 60970

- Sales: (815) 432-2418